OPEN bank is a neobanking network that is rapidly altering the business banking landscape. OPEN banks motto is to assist companies with their financial issues and provide them with the best financial services. Neobanks are similar to banks in that they are online-only financial institutions. In comparison to conventional banks, neobanks typically offer less services—often only a checking and savings account. Customers of neobanks also benefit from lower fees and higher-than-average interest rates as a result of the slimmed-down model.

OPEN Bank provides its customers with a current account that comes with a VISA business card that combines banking, payments, accounting & expense management, in one place. And you need only one account to manage all your payment related services. Through OPEN bank, do banking like everyone has always wanted – Simpler, Smarter and Better.

Key features of having an account with Open Bank are:

- An online bank account with payments, accounting & expense management.

- Make direct payouts from an online bank account, without adding beneficiaries.

- Easily separate your personal & business spends Set limits & assign virtual & expense VISA cards to manage team spends.

- Tag payments & expenses to automate accounting in real-time.

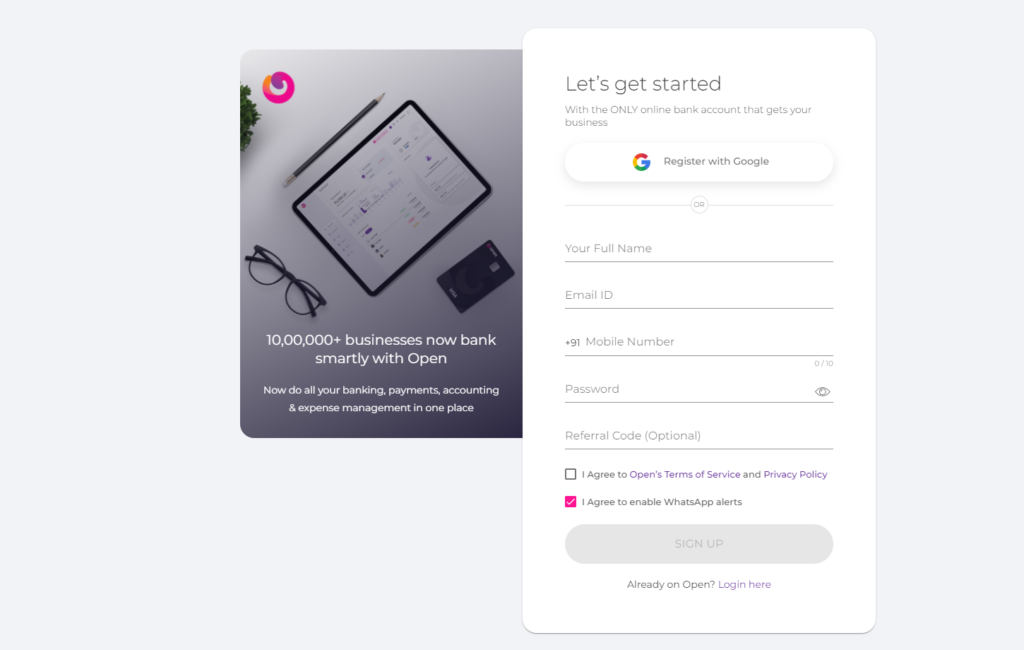

How to Open an account with OPEN?

It’s really very simple to open a Bank account with Open as it only consist of three steps:

STEP- 1: Sign Up – Share your contact info & a few business details.

STEP- 2: Complete Your KYC – Share a few basic details & get an online bank account with a VISA business card. Start transacting immediately.

STEP- 3: Bank Limitlessly – Share a few basic details & get an online bank account with a VISA business card. Start transacting immediately.

Features

The Open account includes smart and efficient features that streamline and simplify banking, payments, payroll, and expense management.

Collect Payments

Send GST invoices, payment links, or use OPEN payment gateway to incorporate your payment gateway into your app or website. With Open’s payments solution, which is integrated with a business account, you can do things like instant bulk payouts, fast invoicing, and more.

Send Payouts

The simplest method for making single or bulk payouts without the hassle of adding beneficiaries. With Open’s payments solution, which is integrated with a business account, you can do things like instant bulk payouts, fast invoicing, and more.

Automate Accounting

With easy to use and powerful OPEN’s software Create bookkeeping records, auto-categorize your profits and expenditures, and integrate with third-party accounting software. Manage all of the accounting in one place, from bookkeeping to invoicing and automatic payment reconciliation, using Open’s business account.

Expense Management

With Open, you can now split your company and personal expenses. With virtual and expenditure VISA cards, you can easily handle and monitor team expenses. Your Open online bank account is now compatible with the smartest business cards in town.

Better Banking

In one dashboard, you can link and track all of your existing current accounts, as well as display bank statements. Manage the company’s finances with ease using the Open account, which includes expense management, automated accounting, and much more.

Powerful APIs

With Open’s APIs, you can do everything from sending payments from your bank account to collecting payments via virtual accounts, making instant refunds, and everything in between.

Who can use OPEN?

Freelancers

With Open’s business account designed specifically for freelancers, you can enjoy quick international payments, the best debit card option, and much more. And it is very easy to use very well for freelancers who are beginning freelance as a career and for those who are already freelancing for years.

SMEs

With Open get a business account that covers all your SME financial needs – right from automated accounting to expense management & everything in between. As open provides you with plans that are especially for SMEs.

Startups

A corporate account that includes everything you’ll need to effectively handle your startup’s finances, from expense management to automated accounting.

Developers

With Open’s APIs, you can do everything from sending payments from your bank account to collecting payments via virtual accounts, making instant refunds, and everything in between.

Partners

If you want to join the Open you can join as a partner in their partner to help entrepreneurs manage business finances the smart way.

Pricing

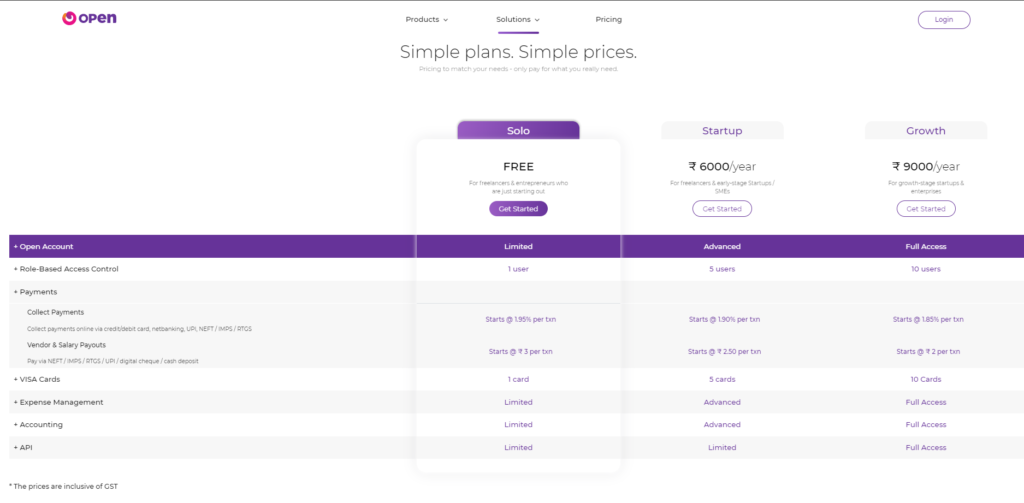

The Open platform offers three different pricing plans for their clients which are:

- Solo

- Startup

- Growth

Solo

Solo is the pricing plan which is free of cost and it is basically for all the freelancers and entrepreneurs who are just starting with.

In this plan you can get benefits of opening an account with open but with limited access and only one user can control it.

You can collect payments in this plan with any median like cards/netbanking/upi with charges @ 1.95% per transaction. And can pay anyone with just @ Rs.3 per transaction.

You will get only one card with this plan with the limited access of Expense management, Accounting and API.

Startup

Startup is the pricing plan which is for freelancers, startups and SMSs who are at an early stage of business and the price of the plan is only Rs. 6000/year.

In this plan you can get benefits of opening an account with open but with Advance access and only Five users can control it.

You can collect payments in this plan with any median like cards/netbanking/upi with charges @ 1.90% per transaction. And can pay anyone with just @ Rs.2.50 per transaction.

You will get five cards with this plan with the advance access of Expense management, Accounting and a limited access of APIs.

Growth

Growth is the pricing plan which is for startups and enterprises who are at the growth stage of business and the price of the plan is only Rs. 9000/year.

In this plan you can get benefits of opening an account with open but with full access and Ten users can control it.

You can collect payments in this plan with any median like cards/netbanking/upi with charges @ 1.85% per transaction. And can pay anyone with just @ Rs.2 per transaction.

You will get ten cards with this plan with the full access of Expense management, Accounting and API.

So this was all about Open, an amazing platform for you and your business to grow and do transactions with a very easy and easy to manage platform. With Open it’s very simple to manage your account and do accounting. Get Your Account Now.