Bank Of Baroda Startup Current Account

Experience our range of Banking Solutions for Start-Ups Experience our range of Banking Solutions for Start-Ups

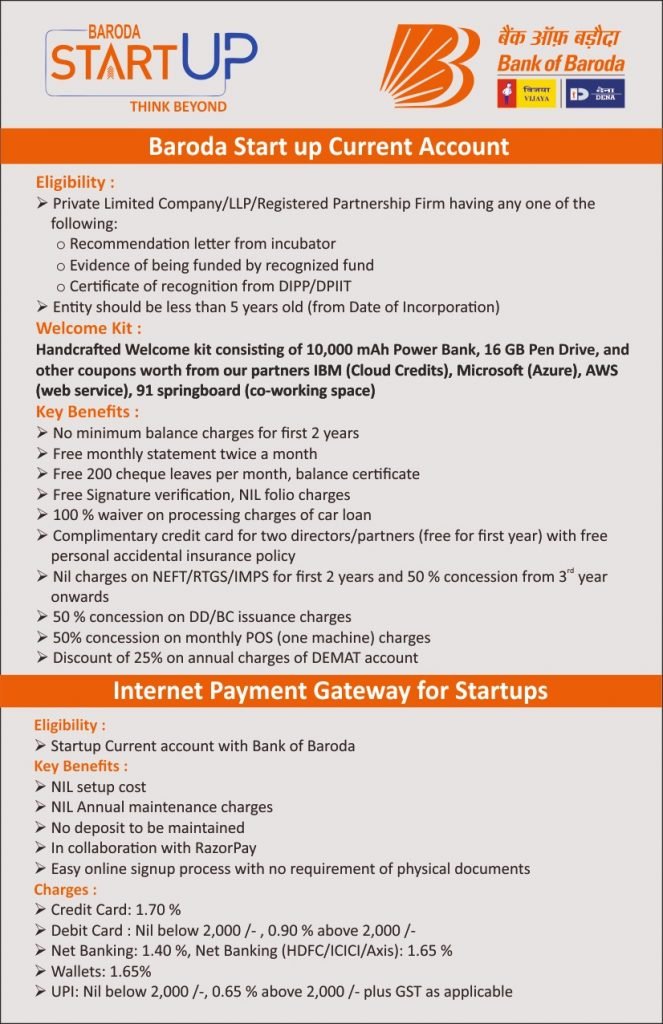

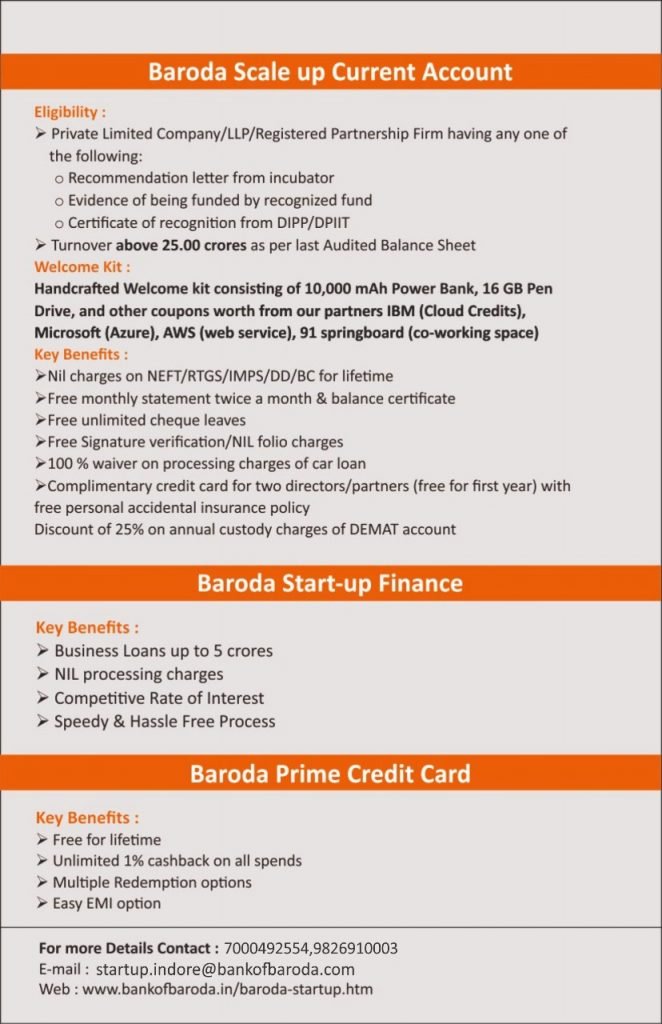

Baroda Startup Current Account

A private limited company or a registered partnership firm or a limited liability partnership working towards innovation, development or improvement of products or processes or services, or having a scalable business model with a high potential of employment generation or wealth creation.

Key Benefits –

- No charges for NEFT/ RTGS/IMPS transactions up to 2 years.

- Auto and Reverse Sweep facility enabling Current account holder to earn interest.

- Monthly statements: Two times in a month free of charge.

- Balance Certificate: Free.

- Folio Charges: Free.

- Signature verification: Free.

- Cheque book: 200 cheque leaves are free per month upto 2 years.

- Free Baroda Connect (Internet Banking)

- Value added SMS Alert Facility: Allowed.

- POS, Bharat QR Code & Bhim QR Code: 50% of POS (one machine) monthly charges.

- 50% discount on issuance of Demand Draft / Bankers cheque.

- Demat Services: Waiver of 25% of annual custody charges to partners and directors.

- Processing charges: 100% waiver in case Car Loans are in the name of Partners and directors of the Company.

- Collection of outstation cheques by sending cheques physically through post – 50% of Normal collection charges.

- Credit Card: Complimentary credit card (free for first year) limited to two partners or two directors with free personal accidental insurance facility.

- Baroda Cash Management Services: Enjoy the convenience of BCMS services for bulk payment & collection at competitive rates offered by the Bank.

- Baroda Payment Gateway: Accept online payments through all modes through state of art payment gateway of the Bank.

MITC

Transactions

All genuine purpose oriented transactions are allowed. There is no restriction on number of transactions in the current account

Transfer transaction

In case of transfer transaction one entry i.e. either debit or credit entry of the transaction must be in the branch transferring the fund

Cash Deposit

At base branch and local non-base branch:

- Upto Rs.50000/- Or Up to 10 packets i.e. 1000 pieces of notes of any denominations taken together, whichever is higher – free of charge per day. For additional 1000 pieces (10 packet) or part thereof charges @Rs.10/- (Min Rs.10/- & Max. Rs.10,000/-) will be charged.

At outstation branches:

- There is no restriction for cash deposit in outstation branches if PAN is available in the account. Service charge will be levied as under:

| Shortfall in Average Balance | Slab of Charges |

|---|---|

| Up to 25,000/- | NIL |

| Above 25000 to 50000 | 25/- |

| Above 50,000/- to 1 Lac | 50/- |

| Above 1 Lac | 100/- |

Minimum Balance Requirement

After 2 years from date of opening of current account, minimum QAB to be maintained is Rs.75,000/-. Service Charge of Rs 1000/-+ GST for Non-maintenance of QAB.

Interest Payment

No interest is payable in current account.

Withdrawal(s)

Withdrawal allowed by cheque only. No upper limit for cash withdrawing at base branch. At local non-base branch and outstation branches Cash withdrawal up to Rs.25,000/- per day per account is free of charges thereafter service charges is levied @ Rs.2/- per thousand or part thereof minimum Rs.50/- and cash withdrawal is allowed to account holder up to Rs.50,000/- per day only by self cheque. Third party cash payment at non-base branches is not allowed.

Statement of Account

Statement of Account is provided twice a month free of cost. Duplicate statement will be issued with present balance only @ service charge of Rs.150/-+ GST. For old entries the charges are Rs.150/- per ledger page.

Standing Instruction

For Standing Instruction within the Bank there is no charge. Charges @ Rs.50.00+Remitance Charge+ Postage charged for Standing Instruction sent out of the Bank. Charges @ Rs.100/-per occasion will be deducted if the instruction could not be executed on a particular date due to insufficient balance.

Transfer/ Closure of Accounts

A/c cannot be transferred from one Branch to another Branch. For closure of Current account within one year @ Rs.600/-+ GST will be deducted.

Unclaimed Deposit

Account remaining Dormant for 10 years are treated as unclaimed deposits and are transferred to RBI.

DICGC Insurance Cover

Details of insurance cover in force under the scheme offered by Deposit Insurance and Credit Guarantee Corporation of India (DICGC) to the extent of Rs.1/- lakh per depositor.

Addition/deletion of Partners/ Directors

Rs.100/-+GST per occasion.

Change of Authorized Signatory

Rs.250/- per change

Stop Payment

Rs.200/-+GST per Instrument; Rs.1000/-+GST for whole cheque Book

NEFT/RTGS/IMPS (Outward and Inward)

Free for 1st 2 years from the date of account opening, thereafter 50% of applicable charges

Opening A/c with restrictive operation

Rs.500/- per instruction

Cheque Return Charges

Inward Return Charges : Rs.125/-+GST (Up to Rs.1 Lac), Rs.250/-+GST (Rs.1 Lac to 1 crore) & Rs.500/-+GST (Above 1 Crore). Outward Return Charges Rs.250/-+GST (Up to Rs.1 Lac); Rs.500/-+GST (Rs.1 Lac to 1 Crore) & Rs.750/-+GST (Above 1 Crore) Financial Reason (both for drawer & payee). If Cheque returned for Technical Reasons for no fault of Customer no charges are deducted.

Copy of original of cheque / DD (paid by the Bank)

Rs.100/-+GST upto 6 months old record, beyond 6 months- Rs. 250/-+GST

Sweep facility

- The threshold limit in this account is Rs.5,00,000/- which can be increased in multiples of Rs.1000/- at the choice of the customer.

- First Sweep out for Rs 25,000 will take place only when account balance reaches Rs 5,25,000/- for 30 days by default though it may change at customer’s request between 15 to 45 days.

- Sweep out amount of Rs 25,000/- can be increased in multiples of Rs 25,000/-

- Sweep will take place on every Monday. In case of holiday, sweep will take place on the next working day.

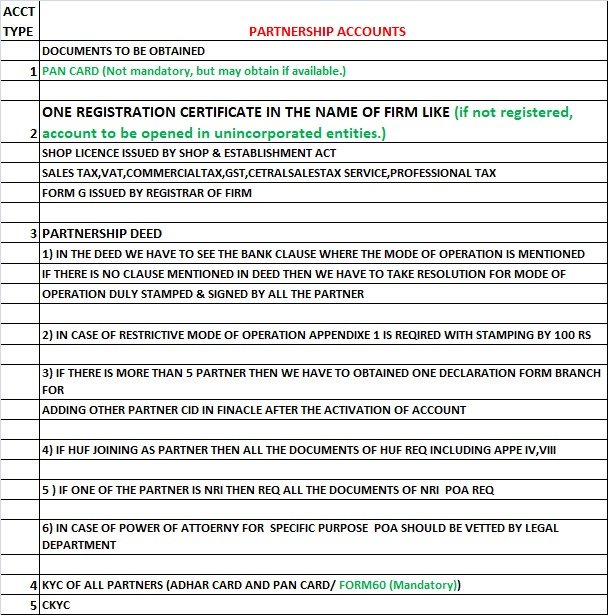

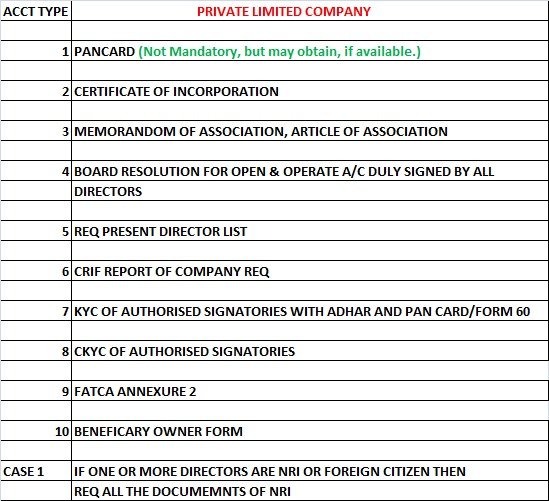

KYC Documents:

- As per KYC guidelines issued by the Bank.

- Any one of

A) Recommendation letter from Incubator established in a post-graduate college in India/Incubator recognized by Government of India/Incubator funded by Government of India or State Government or

B) Evidence of being funded by recognized funds or

C) Certificate of recognition from DIPP/DPIIT

Rules for Transfer/ inter-sol transfer/clearing transactions and charges

Transfer Transaction at base branch

- Allowed freely without any limit

Transfer Transaction at Non-base branch (local as well as outstation)

- Normally allowed only at a branch where either drawer or payee maintains account. However, for genuine transactions, Branch Head is authorized to allow transactions at non-base branch (where neither drawer nor payee maintains account) on case to case basis subject to certain conditions. There are no charges for Inter-sol transfer transactions.

Clearing Transactions

There is no restriction for clearing transactions *All Charges are exclusive of Taxes. *All charges are subject to changes from time to time. *For latest service charges, please visit our website www.bankofbaroda.com

Disclosure The Bank may disclose information about Customer’s account, if required or permitted by law, rule or regulations, or at the request of any public or regulatory authority or if such disclosure is required for the purpose of preventing frauds, or in public interest, without specific consent of the account holder/s.

All relevant policies including code of commitment to customers and grievances redressal policies are available at the branch. The bank will notify, 30 days in advance regarding any change in Terms & Conditions/ fee and charges on its website.

*All Charges are exclusive of Taxes.

*All charges are subject to changes from time to time.

*For latest service charges, please visit our website www.bankofbaroda.com

FAQS –

Who can open a current account?

An individual, proprietorship and partnership firm, limited company and even a limited liability partnership can open a current account. For specific eligibility criteria on current account opening, contact the nearest branch.

What is the minimum balance needed for a current account?

One of the benefits of a current account is the low minimum average quarterly balance. However, this amount varies based on the type of current account you hold. Ask your relationship manager or bank executive for more details.

What are the benefits of a current account ?

With a current account, you can do a large number of transactions in a single day. You also access several banking services free of charge, depending on the type of current account. This includes applying for overdraft facilities on your current account.