What Is Escrow?

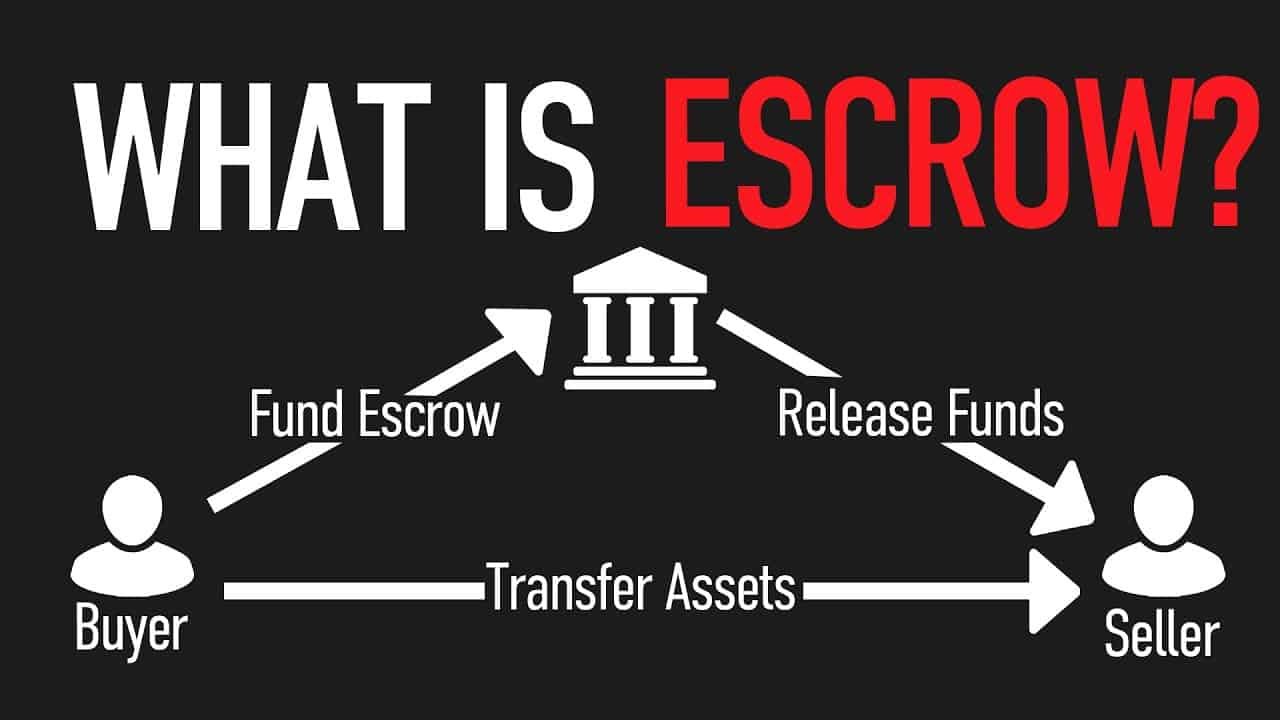

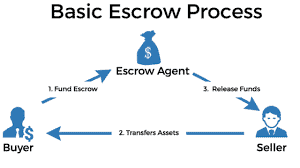

Escrow is a financial agreement in which a third party (who is neither the buyer nor the seller) is enlisted by two parties to temporarily retain on their behalf money, documents or other properties for a transaction until the transaction is finalised.

The third party, known as an escrow service, facilitates the deal safer by securing the buyer’s and seller’s properties until all parties have satisfied their contract obligations.

In this case, the selling, acquisition, and possession of a property, think of escrow as a mediator that eliminates risk on both sides of a transaction.

How Escrow Works

You agree to follow those requirements when you commit to buying or selling something. For example, at a particular time, the buyer must pay the agreed-upon sum, and the seller must supply the asset being sold. Most transactions are of course, more complex than that. For instance:

Before paying, consumers may want the right to inspect the property or products they are purchasing.

Sellers will want some guarantee that they will be paid (or have the chance to move on if the deal does not happen).

One party can feel doubtful that the other will uphold its end of the deal in complex agreements such as these, creating the need for a third party to serve as a’ referee.’ The escrow provider acts as this intermediary and ensures that the buyer and seller do what they agreed to do.

In a transaction, the escrow provider’s roles include collecting assets from one entity, disbursing funds under the terms of the escrow agreement, and closing escrow.

Escrow is used to temporarily keep the earnest cash (or good faith deposit) of a buyer when it comes to real estate purchases, which indicates a degree of seriousness in going through with the actual purchasing of the property.

After the completion of purchase, escrow may also be used to retain a portion of the monthly mortgage payment of the homeowner, which is then automatically placed against tax and insurance payments.

Who is Escrow agent

An escrow agent is an individual or agency which, when a transaction is completed or a dispute is resolved, holds property in trust for third parties. An attorney often plays the role of escrow agent (or notary in civil law jurisdictions).

For all parties of the escrow arrangement, the escrow agent has a fiduciary obligation.

In the form of an escrow arrangement, an escrow agent basically acts as a neutral middleman. An escrow arrangement is a contract between two parties whereby each party agrees that once their transaction is completed, a third party should retain an asset on their behalf. The funds or properties are kept by the escrow agent until the required instructions have been obtained or until predetermined contractual obligations have been fulfilled. All capital, securities, funds, and real estate titles may be kept in.

Different escrows assigned for different services

- Escrow for real estate

When you purchase or sell a home, Escrow is widely used. When a signed document is sent to an escrow officer who guarantees that the terms of the contract are all met, Escrow opens. The officer must check, for example, that home inspections, disclosures, and objections are done or resolved on time.

In a home sale, an earnest money deposit is probably the first time you’ll notice escrow. A check payable to the escrow holder is written by the buyer, who will either reimburse the money, add it to the purchase price, or transfer forfeited funds on to the seller if the buyer fails to satisfy the contract’s requirements. When the buying money is disbursed to the seller and the title is reported in the purchaser’s name, Escrow closes.

You will usually come up with earnest cash after you make an offer on a home, and that offer is accepted. To show the home seller that you are serious about buying their home, you (or your real estate agent) will deposit this money into an escrow account.

The earnest cash from this escrow account is issued after the real estate deal closes and you sign all the requisite paperwork and mortgage papers.

- Escrow online

For more than just home sales, escrow services are valuable. Online transactions are especially dangerous; you’re dealing with someone you know nothing about, and they could be a lot of miles away (so taking legal action against a swindler would be very costly to be worth it).

You do not get the products you ordered as a buyer dealing with a deceptive seller. Furthermore, online scammers regularly take advantage of vendors.

If you enlist an escrow service for that transaction, the buyer and seller just need to do what they agreed to do after supplying the service with that information. The customer gets her money back from the escrow company if the vendor never sends anything.

The seller and escrow company can check shipping confirmations if the buyer says the products never arrived (which some people claim to get stuff for free). Based on such confirmations, if the buyer agreed to finish the transaction and there is evidence.

- Escrow for stock market

In escrow, stocks are also released. In this situation, while the shareholder is the true owner of the stock, when it comes to the disposal of the stock, the shareholder has restricted rights. Managers who accept stock as an incentive for their salary, for instance, frequently have to wait until an escrow period passes until they can sell the stock. A strategy used to retain top executives is stock incentives.

- Escrow for taxes and insurance

Escrow can be stopped and your own taxes and insurance can be charged under some conditions. This will lower the monthly mortgage payment, but separate contributions for property taxes and homeowners’ insurance will have to be made.

You may be able to opt out of making an escrow account if you purchase or refinance a property, but in some cases, the laws of the state you are in may want you to have a particular amount of equity or a minimum down payment.

A short-term account is the escrow account used to purchase your home. But after closing, for the duration of your loan, a second escrow account, opened by your lender, will be used.

The majority of lenders demand that when you sign a mortgage contract, you enter into an escrow arrangement. Your lender will find out what additional cash will be necessary to sustain the mortgage when determining your monthly mortgage payment, then deposit this money into your escrow account.