Overview

Finpeg is a revolutionary new way of investing that combines sophisticated algorithm driven investing with the assurance and warmth of human-assisted transacting. Hence at Finpeg, while we’ve built what we believe is arguably the most advanced algorithm driven robo-advisory platform for designing investment portfolios, our primary endeavor is to ensure our customers don’t end up having to talk to a “robo”; instead they always have a friendly and trusted advisor at hand to handhold them through the initial on-boarding and the subsequent investing journey while our cutting-edge technology works behind the scene to make their money work the hardest.

Headquarters -Thane, Maharashtra

Type -Privately Held

Founded– 2016

Specialties -Mutual Funds, Investment Advisory, AlphaSIP, Lumpsum Strategy, Monthly Income Plan, Tax Saving Mutual Funds, Algorithm-based Investing, and Robo Advisory

My Personal Review –

Easy and Solution for beginners in Investment

I am in a busy job and investing and researching is not my cup of tea. I just dont have time for it. Its then when I came across scripbox.

Its a great website with some best suggested mutual funds for all your needs. They finalize a list and review it and change it every year if necessary. They say they have an algorithm through which they suggest best performing assets in debt, tax saving and totally share market oriented options.

Its easy to use for every investments its just matter of clicks and ure good to go. You can even start SIPs and track it easily. I’ve using this for more then a year now and its the best that ive found easy for me to have less options to choose and get great returns.

5/5 🙂

Firstly, let’s closely examine why people all around are recommending direct funds instead of their regular counterparts…

- Total Expense Ratio

Total Expense Ratio (TER) is what you pay the fund house/fund manager for managing your invested money. You avail of an investment service and are charged for it. As simple as that.

TER is different across fund categories and within funds across fund categories. For example, the expense ratio will obviously be different for HDFC Liquid Fund and HDFC Midcap Opportunities Fund since the former is a liquid fund and the latter is an equity fund. However, the TER shall be different for HDFC Midcap Opportunities Fund and HDFC Small Cap Fund too.

For regular funds, the TER is higher than it is for direct funds although there is no other difference between the two. For example, the TER for HDFC Small Cap Fund – Regular and HDFC Small Cap Fund – Direct are not two different funds. It’s the same fund with different TER’s. And without exception, the TER of regular version of a fund is higher than the direct version of the fund.

Now where does this difference in TER go? It goes to the person who sold you the regular version! You advisor, your friend, your relative whoever filled up the forms for you for these mutual fund purchases? You thought he was doing it for free? Absolutely not! Here’s how much he would have earned for filling up your forms –

I am assuming you invested Rs. 10,00,000 in an equity fund A via his help for a period of 10 years. I am assuming that the TER of the regular version of the fund is 2% and for the direct version of the fund is 1%. Another assumption is that the investment appreciated at the rate of 10% PA.

So your ‘advisor’ received about Rs. 2.8 L as brokerage for filling up forms. Absolutely not justified.

This is the main reason why everyone is encouraging you to invest via a fee-only advisor. A fee only advisor would charge you a one-time fee to get you started and a yearly portfolio review fee. This, in no case, would be greater than 1/10th of the Rs. 2.8 L brokerage in the first case. Additionally…

2. Differential Commission Structure

Mutual fund advisors (who sell you regular mutual funds) do not have a fixed commission structure. The idea is pretty simple –

If a product isn’t getting merit-based market traction, the company selling the product starts further incentivising the ground level distributors or sellers of the product. Not so great (or new) mutual funds are not different from this generic, not-so-great product.

If your advisor has ever seemed adamant about a particular financial product (insurance, ULIP’s, NFO’s) or a particular mutual fund, it would be pretty safe to assume that he was hard selling you the financial product for his own benefit more than your financial well-being.

This is apprehension 2 – If you are investing through regular mutual funds, the possibility of being sold a mutual fund that benefits your financial advisor more than it does you cannot be completely eliminated.

A fee-only advisor, on the other hand, would be agnostic to brokerage structures and more likely to recommend you the right funds and right financial products.

So if you are going to invest in SIP’s, STP’s or SWP’s, please do so only through direct funds after a detailed study or under the guidance of a fee-only financial planner.

If you are looking to invest in better investment mechanisms that are better in risk-return aspects than the ones mentioned above, Finpeg is your destination.

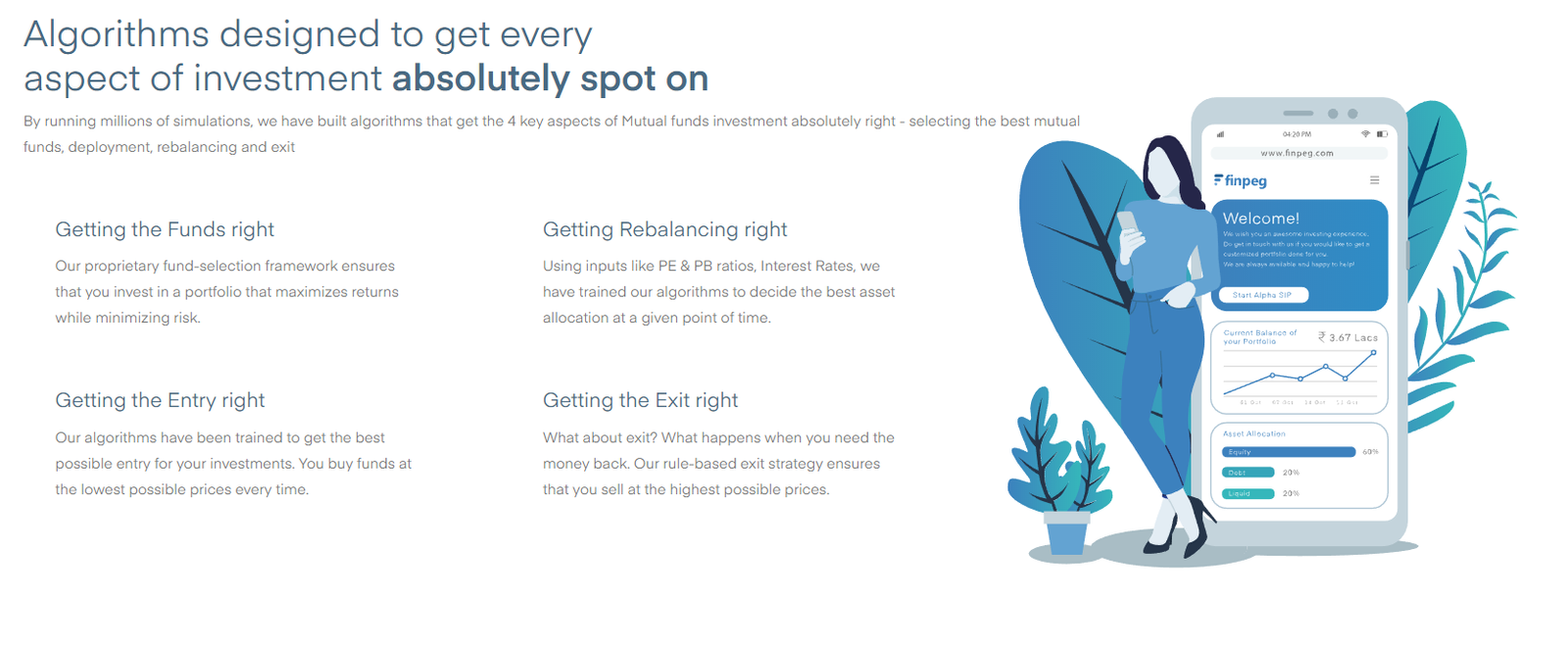

At Finpeg, we do not recommend investment mechanisms like SIP’s, one-time lump-sum, STP’s or SWP’s. We have designed some impressive investment mechanisms in-house after having stress-tested them for various market periods.

The past performances of these investment mechanisms is such that not only do they compensate you for having invested in regular funds with Finpeg but have a very high probability of exceeding the returns of investments made in plain vanilla mechanisms in direct funds. A simple illustration is as follows –

Assumed rate of return you generate via Finpeg’s Lumpsum Investment Strategy is assumed as 14% PA – a very conservative assumption to be honest.

The simple point that I am trying to make is if Finpeg can give your investments an edge that not only compensates you for what Finpeg charges you for portfolio management but also exceeds those charges, how does it matter whether we invest via direct funds or regular funds?

You have three options –

- Finpeg Lumpsum Investment Strategy

- Simple lumpsum in direct funds

- Simple STP in direct funds

If it can be proven through simple logic and hard data that Finpeg’s lumpsum investment strategy is unbeatable by a stretch, why think further?

We are trying to create a win-win situation wherein not only do we make money for managing your money, but also manage your money better than anyone else in the country. We earn the commission (which is an absolute bargain for our products to be honest!) and you earn the extra returns that you wouldn’t have otherwise:)

We have a product for a monthly investment strategy called the Alpha SIP in which we create an Alpha over a plain vanilla SIP every time.

We have a one-of-a-kind Finpeg Monthly Income Plan especially designed for retirees or anyone who needs a regular monthly income. Why should market volatility decide when you make money and when you don’t?

So yes, it does make sense to invest in Finpeg’s investment algorithms even though we execute them on regular funds because not only are you compensated for the commission that accrues to us but also exceed what anyone else would make via direct funds. As simple as that.

If you are interested in understanding what makes us so confident of better performance than the rest, give us a shout. We’ll get back to you within 48 hours and help you understand everything.

Official Website = https://finpeg.com/

Unit no. 325, C-1, 3rd Floor, Soham Plaza, Manpada, Thane West, Maharashtra – 400607Email: hello@finpeg.com Phone: +91 90829 13729