Most banks offer Internet banking, and you can cover your tabs, move cash, and access a record of your financial records exchanges, all from your internet browser.

Banking from the solace of your couch causes all that you to do with your funds somewhat simpler. An ever increasing number of banks permit you to store checks by just snapping a photo of the check with your telephone. You can get to your financial data anyplace that you approach the Internet, on your PC or cell phone.

You may choose to change your records to an online-just bank later on. These banks offer the greater part of similar points of interest online as a conventional bank, yet online-just banks have no physical branch areas. While this may appear to be an issue, online-just banks offer a couple of advantages that may make it worth the exchange off.

Internet Banking Advantages

Pay Your Bills Online

One of the advantages of online banking is you can bank at home.

Robert Warren/Taxi/Getty Images

You can use your bank’s online site to pay your bills and protect yourself from having your check get lost in the mail. Most banks will have a section in which you set up payees. You will need to fill out the information once, and then you can simply choose that profile every time you pay a bill online.

If your bank will not pay bills online, you may consider paying through the company’s website. Be careful since some of these companies may charge a convenience fee. Some places will charge a fee for a debit card, but not if you set up a direct debit.

If you access your bank’s website on your mobile phone, the bank’s app typically allows you to deposit checks with just a snapshot of the document. This means that you can handle all of your banking without ever going to the bank. However, keep your eyes open for any convenience fees associated with online bill pay.

View Your Transactions

Online banking allows you to access your account history and transactions from anywhere. This is the quickest way to check and see if a transaction has cleared your account. You can also find out the amount of a transaction after you have lost your receipt. It also allows you to find out about unauthorized transactions more quickly, helping you resolve any issues right away.

Some banks will show you pending transactions. These are transactions that you made that day. If you spot something you did not authorize, you can contact your bank and the vendor in order to reverse the charges. The sooner you catch a problem like this, the more quickly you can resolve it. Pending transactions may not be for the exact amount of the purchase. For example, if you leave a tip, this will not show on the pending transaction, so keep that in mind as you balance your account.

Transfer Money Between Accounts

Online banking also allows you to transfer money between accounts much more quickly and check on your available funds before spending money. It is more convenient than using the automated phone service and can save you a trip to the bank.

When you apply or set up your online banking, be sure that all of the accounts you have at the bank are listed. This will make it easier to transfer money and make loan payments online.

You also have the option of transferring money between different banks online. This will not happen as quickly since the money still needs to go between financial institutions, but it is much more convenient than running to the bank.

Depending on the type of account, your bank may limit the number of online transfers and may hit you with a fee if you go over.

You can also use online banking to manage your money better by setting up more than one savings account at the same bank. Not all banks offer this, so check around.

After each paycheck, for example, you can go online and transfer money to different savings accounts to save for various goals, such as an emergency fund or a down payment for a new home.

Mobile Banking

Most banks will have a mobile app that allows you to take advantage of online banking on your phone. This makes online banking even more convenient and allows you to quickly check up on your account when you are out shopping, transfer funds over if you’re short, or check to see if a merchant has double-charged you.

However, you need to be sure you are accessing this information on a secure network and avoid using public WiFi while completing these transactions. Mobile banking makes online banking even easier.

Syncing With Your Money Applications

Many money apps will automatically sync with your online banking information. This makes sticking to your budget much easier. Apps will often work both on your home computer and your mobile device so you can stay up-to-date while you are on the go. It is also easier to track your spending for your budget if you are using one of these apps.

It’s becoming much less common to receive paper statements, but it is still important to balance your account to your bank each month to prevent you from overdrawing your account. If your bank is small, it may not offer the syncing function, but you can still update your accounts each day by logging on and entering your accounts manually.

One of the best uses is that you can sync spending in real time so that if you and your partner shop separately, you do not overspend without realizing it.

Online-Only Banks

All of the above benefits apply to both traditional banks with an online presence and online-only banks.

One of the most enticing features of online-only banks is the higher interest you’ll receive on your savings and other financial products such as CDs. These banks have much less overhead to pay, and they pass the savings on to their customers. Other benefits include:

Lower service and maintenance fees than you would pay with a traditional bank

No bank branches, which means you might save more because you can’t walk into a branch to get cash

Good or even great customer service, because online banks dedicate a lot of their financial resources to data collection and ongoing customer-facing process improvements

Doing your part to preserve resources by going with online-only banking, because traditional banks use a lot more resources, such as paper and electricity, among others, compared to online-only banks

Protect Yourself Online

It is important to be careful when banking online as you do not want your safety or privacy to be breached. It is important to clear the cookies after each banking session if you are at a public computer.

Additionally, make sure that your password is long enough to prevent it from being hacked and never give your online account information to someone who is not an authorized signer. You should make sure to protect your password, especially if you have roommates. Also, check your credit report regularly. These steps should protect you from identity theft.

Take the time to make the necessary precautions, and monitor your account regularly for fraudulent charges

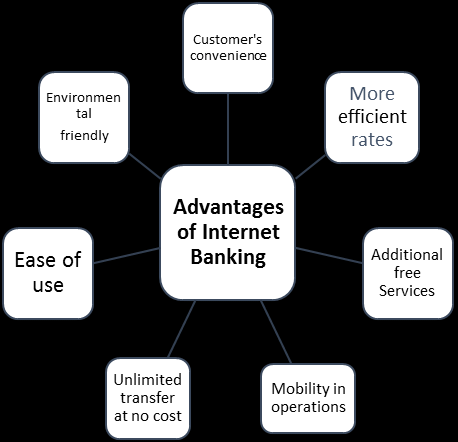

Internet E Banking Advantages

1.Convenience

Right now boisterous calendar it is hard for a person to make time to visit bank for checking their record balance, loan fees, fruitful exchange of cash, and some other update. Banking framework has created virtual financial framework for client accommodation where an individual can get to their financial framework whenever and wherever. There are numerous situations when there is banking occasion because of which your cash can’t be moved. Web based financial framework has gives a simplicity by giving 24 hours and 365 days administrations. It settle issues looked by the clients during conventional financial framework. An individual don’t have to remain in line for any cash extradite and move.

2.Transfer assistance

The virtual financial framework gives accommodation to move cash 24 hours in 365 days. You don’t have to adhere to play out any exchange inside working hours as you can do according to your benefit in 24 hours.

3.Monitoring assistance

The clients can get to their refreshed passbook whenever for screen their exchanges to deal with their money related plans.

4.Online bills installment

You don’t have to remain in line for taking care of tabs as it has highlight to take care of any sort of tab including power, water supply, phone, and different bills.

5.Quality help

Web banking has improved the nature of administrations by giving them comfort to play out their exchanges whenever during the day. The buyers can apply for credit, protection, and some other administrations without visiting the banks truly which shows that the nature of e-banking is quick and compelling.

6.High liquidity

You can move cash and use whenever which is the best bit of leeway to get to web banking. You don’t have to visit banks for moving cash which should be possible from anyplace without visiting to the banks genuinely.

7.Low cost banking administration

Web banking diminish empower to lessen operational expenses with better nature of administrations. It gives accommodation high client care at lower rate. The Bank charges negligible sum for tasks which mirror that the e-banking administrations are sensible and productive.

8.High loan fees

Internet Banking gives low financing cost on contract advances than banks. The operational expense is likewise low which serves to sparing sum that is gainful for the clients. There are different offices, for example, no base equalization account which assists with keeping up account with zero parity.

Advantages of Online Banking

Some advantages of online banking go hand-in-hand with simply being online; others are competitive advantages provided by online banks taking advantage of their cost structure. The most prominent benefits provided by online banking include:

- 24/7 account and service access

- Speed and efficiency

- Online bill payment

- Low overhead can mean low fees

- Low overhead can mean high interest rates on deposit accounts

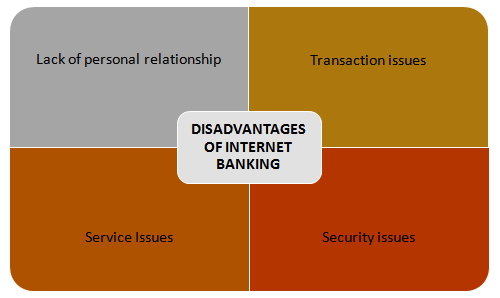

Disadvantages of Internet e-Banking

E-banking has various advantages which improves the banking system but there are disadvantages of using internet banking. These are as follows:

1.Security issues

Internet banking is completely insecure as there are many problems related to the website and data can be hacked by the hackers. It can leads to financial loss to the users. The financial information can also be stolen that can also create financial loss.

2.Lack of direct contact between customer and banking officer

Online banking requires effective customer service for handling issues faced by the user. But lack of customer support creates disappointment among the customers. There are some online payments which may not be reflected in the system due to technical issues. It also creates insecurity among the customers. Thus the lack of support from customer service executive is a barrier in online banking.

3.Transaction problem

During online banking there are various issues faced by the user such as transferred payment is not reflected, payment failed, and other issues due to technical support.

4.Long procedure to access e-banking

In some countries, government banks are providing internet banking by filling the internet banking form then after approval you can access security password to log in. An individual need to download the App of specific banking then all credentials needs to be filled for login successfully (Sharma, 2016).

5.Training and development

The banks need to conduct training and development program for employees for providing quality online services which enhance the customer experience. It requires huge investment to train them for providing effective services.

Security Risks

Most banks ensure that their sites are secure, yet no bank site is invulnerable from digital wrongdoing and hacking. Programmers target bank sites to swipe account data. Not exclusively can wholesale fraud put you out of hundreds, maybe even thousands, of dollars, however it can set aside effort to address the harm, and it’s evaluated that lone 25 percent of digital violations are settled. So despite the fact that your bank may guarantee that its site is secure, you ought to consistently continue with alert, particularly in case you’re banking from your cell phone.

ATM

One inconvenience of Internet banking identifies with pulling back cash. While most organizations acknowledge charge and Mastercards, individuals despite everything like to have money on them as well. Subsequently, you can’t pull back money over the Internet so you despite everything need to visit your bank’s physical area, or eat administration expenses by pulling back cash at an ATM that is not related with your bank. This turns out to be significantly all the more testing on the off chance that you have a place with an online-just bank, as you might be compelled to pull back money through snail mail or paying ATM charges at each withdrawal.

Store Limitations

All things considered, your check is straightforwardly stored into your financial balance, sparing you an excursion to the bank. In any case, there are still occasions when you’ll need to make a store to your record. Albeit numerous banks have discharged portable applications that permit you to examine a photograph of your check for programmed store, this component is helpful just for individuals who claim advanced cells. The individuals who don’t must visit their bank’s physical area to store cash or send the store in by means of snail mail for online-just banks.

Client support

Albeit online banks have actualized talking highlights and offer client care numbers for those with questions and requests, it despite everything doesn’t measure up to the client care you’ll get by banking at a physical bank area. For example, in the event that you are nearby, you can meet with workers and get data on significant subjects, for example, financing, charge card rates and sorts of credits all notwithstanding standard banking.

The 10 Best Banks In India (2020)

1. HDFC Bank

HDFC Bank is one of India’s leading private banks and was among the first to receive approval from the Reserve Bank of India (RBI) to set up a private sector bank in 1994.

Today, HDFC Bank has a banking network of 5,345 branches and 14,533 ATMs spread across 2,787 cities and towns.

HDFC Bank Ltd. is an Indian banking and financial services company headquartered in Mumbai, Maharashtra. It has a base of 104154 permanent employees as of 30 June 2019.[] HDFC Bank is India’s largest private sector lender by assets.[9] It is the largest bank in India by market capitalisation as of February 2016.[10] It was ranked 60th in 2019 BrandZ Top 100 Most Valuable Global Brands.

2. Axis Bank

Axis Bank is the third largest private sector bank in India. The Bank offers the entire spectrum of financial services to customer segments covering Large and Mid-Corporates, MSME, Agriculture and Retail Businesses.

The Bank has a large footprint of 4,050 domestic branches (including extension counters) with 11,801 ATMs & 4,917 cash recyclers spread across the country as on 31st March, 2019. The overseas operations of the Bank are spread over eleven international offices with branches at Singapore, Hong Kong, Dubai (at the DIFC), Colombo, Shanghai and Gift City-IBU; representative offices at Dhaka, Dubai, Abu Dhabi, Sharjah and an overseas subsidiary at London, UK. The international offices focus on corporate lending, trade finance, syndication, investment banking and liability businesses.

Axis Bank is one of the first new generation private sector banks to have begun operations in 1994. The Bank was promoted in 1993, jointly by Specified Undertaking of Unit Trust of India (SUUTI) (then known as Unit Trust of India), Life Insurance Corporation of India (LIC), General Insurance Corporation of India (GIC), National Insurance Company Ltd., The New India Assurance Company Ltd., The Oriental Insurance Company Ltd. and United India Insurance Company Ltd. The share holding of Unit Trust of India was subsequently transferred to SUUTI, an entity established in 2003.

With a balance sheet size of Rs. 8,00,997 crores as on 31st March 2019, Axis Bank has achieved consistent growth and with a 5 year CAGR (2013-14 to 2018-19) of 16% in Total Assets, 14% in Total Deposits, 17% in Total Advances.

3. IDFC Bank

IDFC FIRST Bank offers a range of financial solutions to individuals, small businesses and corporates.

4. State Bank Of India

The State Bank of India is an Indian multinational, public sector banking and financial services statutory body. It is a government corporation statutory body headquartered in Mumbai, Maharashtra. SBI is ranked as 236th in the Fortune Global 500 list of the world’s biggest corporations of 2019.

5. Bank Of Baroda

It has been a long and eventful journey of almost a century across 21 countries. Starting in 1908 from a small building in Baroda to its new hi-rise and hi-tech Baroda Corporate Centre in Mumbai, is a saga of vision, enterprise, financial prudence and corporate governance.

It is a story scripted in corporate wisdom and social pride. It is a story crafted in private capital, princely patronage and state ownership. It is a story of ordinary bankers and their extraordinary contribution in the ascent of Bank of Baroda to the formidable heights of corporate glory. It is a story that needs to be shared with all those millions of people – customers, stakeholders, employees & the public at large – who in ample measure, have contributed to the making of an institution.

6. Punjab National Bank

Profile

Punjab National Bank, India’s first Swadeshi Bank, commenced its operations on April 12, 1895 from Lahore, with an authorised capital of Rs 2 lac and working capital of Rs 20,000. The Bank was established by the spirit of nationalism and was the first bank purely managed by Indians with Indian Capital. During the long history of the Bank, 7 banks have merged with PNB.

The Bank’s brand image and trust reposed by its customers have been reflected in growing customer base and rising business graph of the Bank. Domestic Business increased by 5.2 % YoY to Rs. 11,44,730 crore as at the end of December’19 from Rs. 10,87,973 crore in December’18. The Bank continues to maintain its forte in low cost CASA deposits with share at 43.74%. Bank’s focus has been on qualitative business growth, recovery and arresting fresh slippages.

CLICK HERE FOR DETAILED PROFILE

7. ICICI Bank

CICI Bank Limited is an Indian multinational banking and financial services company headquartered in Mumbai, Maharashtra with its registered office in Vadodara, Gujarat. As of 2018, ICICI Bank is the second largest bank in India in terms of assets and market capitalisation. Wikipedia

8. Canara Bank

Founded as ‘Canara Bank Hindu Permanent Fund’ in 1906, by late Shri Ammembal Subba Rao Pai, a philanthropist, this small seed blossomed into a limited company as ‘Canara Bank Ltd.’ in 1910 and became Canara Bank in 1969 after nationalization.

Founding Principles

- To remove Superstition and ignorance.

- To spread education among all to sub-serve the first principle.

- To inculcate the habit of thrift and savings.

- To transform the financial institution not only as the financial heart of the community but the social heart as well.

- To assist the needy.

- To work with sense of service and dedication.

- To develop a concern for fellow human being and sensitivity to the surroundings with a view to make changes/remove hardships and sufferings.

Sound founding principles, enlightened leadership, unique work culture and remarkable adaptability to changing banking environment have enabled Canara Bank to be a frontline banking institution of global standards.

A BRIEF PROFILE OF THE BANK

Widely known for customer centricity, Canara Bank was founded by Shri Ammembal Subba Rao Pai, a great visionary and philanthropist, in July 1906, at Mangalore, then a small port town in Karnataka. The Bank has gone through the various phases of its growth trajectory over hundred years of its existence. Growth of Canara Bank was phenomenal, especially after nationalization in the year 1969, attaining the status of a national level player in terms of geographical reach and clientele segments. Eighties was characterized by business diversification for the Bank. In June 2006, the Bank completed a century of operation in the Indian banking industry. The eventful journey of the Bank has been characterized by several memorable milestones. Today, Canara Bank occupies a premier position in the comity of Indian banks. Canara Bank has several firsts to its credit. These include:

9. IDBI Bank

| Home > About Us |

| IDBI Bank About Us |

| IDBI Bank Ltd., as a full service universal bank, provides a wide gamut of financial products and services encompassing deposits, loans, payment services and investment solutions. We are committed to understanding our customers’ needs and aim at consistently delivering relevant financial solutions and excellent customer service. Understanding today’s fast – paced and digital world, we offer an innovative range of digital services that complement our pan-India network of branches and ATMs. Customers can also reach out to us through our 24×7 customer care facilities. We strive to provide our customers with the best possible combination of safety, convenience and innovation in all of our financial products and services. The vision ‘to be the most preferred and trusted bank enhancing value for all stakeholders’ defines and shapes our day-to-day business, helping us to build long-lasting relationships. |

10. Bank Of India

History

Bank of India was founded on 7th September, 1906 by a group of eminent businessmen from Mumbai. The Bank was under private ownership and control till July 1969 when it was nationalised along with 13 other banks.

Beginning with one office in Mumbai, with a paid-up capital of Rs.50 lakh and 50 employees, the Bank has made a rapid growth over the years and blossomed into a mighty institution with a strong national presence and sizable international operations. In business volume, the Bank occupies a premier position among the nationalised banks.

The Bank has over 5000 branches in India spread over all states/ union territories including specialized branches. These branches are controlled through 55 Zonal Offices and 8 NBG Offices. There are 60 branches/ offices and 5 Subsidaries and 1 joint venture abroad.

The Bank came out with its maiden public issue in 1997 and follow on Qualified Institutions Placement in February 2008.

While firmly adhering to a policy of prudence and caution, the Bank has been in the forefront of introducing various innovative services and systems. Business has been conducted with the successful blend of traditional values and ethics and the most modern infrastructure. The Bank has been the first among the nationalised banks to establish a fully computerised branch and ATM facility at the Mahalaxmi Branch at Mumbai way back in 1989. The Bank is also a Founder Member of SWIFT in India. It pioneered the introduction of the Health Code System in 1982, for evaluating/ rating its credit portfolio.

Presently Bank has overseas presence in 18 foreign countries spread over 5 continents – with 52 offices including 4 Subsidiaries, 1 Representative Office and 1 Joint Venture, at key banking and financial centres viz., Tokyo, Singapore, Hong Kong, London, Paris and New York.